Government Bonds

By: Kellie Beran, Alissa Pecos, and Sami Scott.

Definition

A Bond is a written and signed promise to pay a certain sum of money on a certain date, or on fulfillment of a specified condition. All documented contracts and loan agreements are bonds.

A Government Bond is a bond issued by a national government, generally with a promise to pay periodic interest payments and to repay the face value on the maturity date. Government bonds are usually denominated in the country's own currency.

Definition in our own words

HISTORY

Government bonds were issued in the Netherlands in 1517

First ever bond issued by a national government was issued by the Bank of England in 1693 to raise money to fund a war against France

Bank of England and government bonds were introduced in England by William lll of England

Later, governments in Europe started issuing perpetual bonds (bonds with no maturity date) to fund wars and other government spending.

COOL FACTS

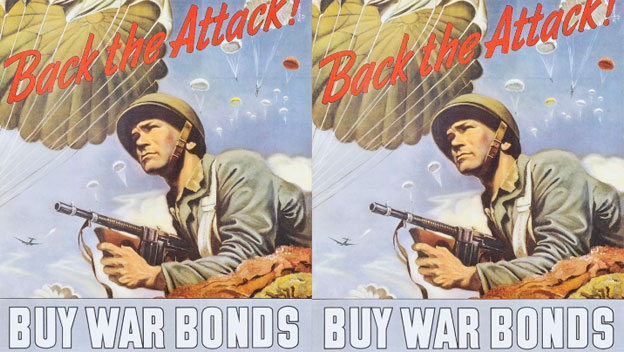

World War 2

- The last time the United States issued war bonds was during World War ll

- Living in the United States with a median income during World War II meant earning about $2,000 a year

- Despite the war’s hardships, 134 million Americans were asked to purchase war bonds to help fund the war

- The war bonds actually were a loan to the government to help finance the war effort.

During WW2 the US government was asking for bonds

This poster made women feel dignified and want to buy bonds

Uncle Sam was used to try to get people to buy bonds

Explanation Video:

Wevideo:

Work Cited

http://www.investinganswers.com/financial-dictionary/bonds/government-bond-5780

http://upload.wikimedia.org/wikipedia/commons/e/eb/GiveUsTheTools.jpg

http://media.liveauctiongroup.net/i/10770/11281112_1.jpg?v=8CE50C0862679B0

http://figures.boundless.com/14873/full/bonds.jpeg

http://i.bnet.com/blogs/muni-bond.jpg

http://www.u-s-history.com/pages/h1682.html

http://www.nnwwiim.org/images/ed-take-a-closer-look-propaganda-bonds4.jpg

http://olive-drab.com/gallery/photos/haveandholdflagwarbondsposter_sm.jpg